New Fiscal Rules Threaten Europe’s Investments in its Future

After months of negotiations, the EU adopted new rules for its economic governance framework. Regrettably, they will require countries to introduce significant budget cuts, leading to austerity measures and ultimately impeding the investments needed to implement a socially just transition.

The EU’s economic governance framework, often seen as a technical and theoretical issue, is deeply political and significantly impacts people’s daily lives, as it determines how national governments can and cannot spend public money. Prioritizing macroeconomic rules over social and environmental goals is a political choice and it is not compatible with SOLIDAR’s vision for a people- and planet-centered Europe.

Old and new rules

Adopted in April 2024, the new fiscal rules aim to reduce debt ratios and deficits while trying to protect reforms and investments in strategic areas such as digital, green or defence. Amongst other things, they re-establish the objectives of the Stability and Growth Pact of maintaining the deficit and debt thresholds of 3% and of 60% of annual GDP respectively, which were suspended after the COVID-19 pandemic and the Russian invasion of Ukraine. Currently, thirteen of the EU’s 27 countries exceed these rules.

The novelty lies in the new numerical safeguards, which require those countries above the 3% and 60% targets mentioned above to reduce their deficit to below 1,5% of GDP and their debt by an average of 1% per year if their debt is above 90% of GDP, and by an average of 0.5% per year if it is between 60% and 90%. Social Platform notes that this numerical safeguard may be too strict and Bruegel points out that in the case of Italy, the margin translates into a structural primary balance requirement of over 4% of GDP.

On a positive note, Social Platform mentions that changes have been made to create more opportunities for reform and investment in shared EU priorities, including the green and digital transitions and social and economic resilience, which includes the social pillar. However, this is largely insufficient considering the massive investments needed to ensure socially just green and digital transitions.

By September 2024, Member States must submit medium-term fiscal-structural plans. Normally, they must consult various stakeholders, but for the first plan, this is not required due to the short timeline.

A return to austerity

The new rules are likely to lead to cuts in public spending, and the effects of the reform are already being felt. Finance ministers of the Eurozone have announced spending cuts and tax increases for 2025. France wants to cut €10 billion from its original 2024 budget and has announced a €1.4 billion cut in its green transition budget. Belgium will have to save €3.4 billion per year. Germany has already significantly reduced its budget for green investments, with negative consequences for its economy.

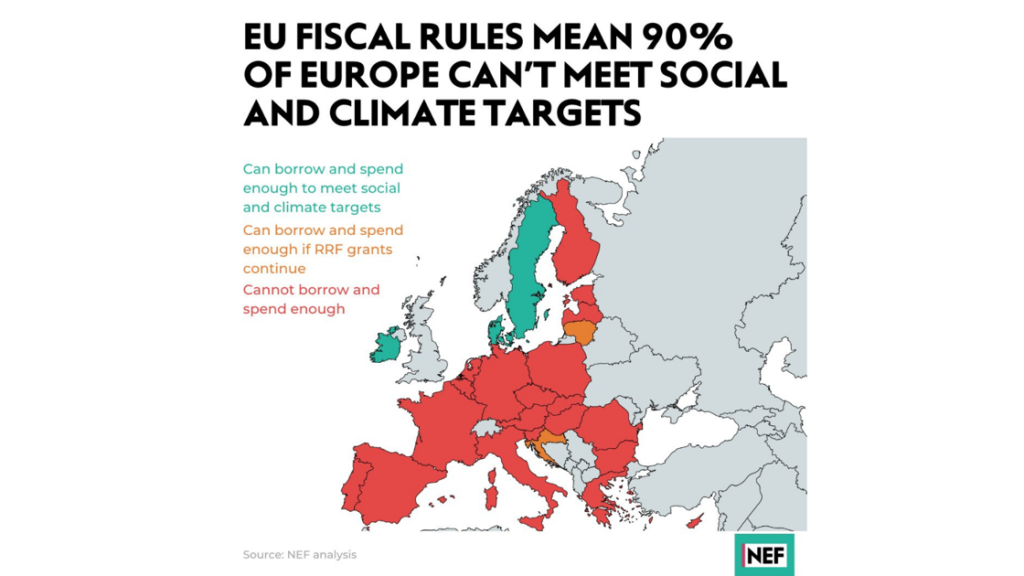

Under the new rules, it will be impossible for governments to invest in a socially just green transition. A study by ETUC and the New Economics Foundation found that 90% of Europe will not meet its social and climate targets and that countries will be forced to make cuts worth over €100 billion in the first year of the implementation of the new rules. Fiscal Matters, a coalition of civil society organisations, think tanks and trade unions, highlights that the new rules will “severely restrict Member States’ capacity to investing a socially just transition to a more sustainable and inclusive future”, with some countries having to undergo significant budget cuts to follow the rules. This will be problematic especially for poorer countries, that are often hit the hardest by climate change, and will not have the capacity to adapt and mitigate its social and economic consequences.

Bridging the climate and social investment gaps

These new rules come into force at a time when the EU needs to invest massively to meet its climate and social goals. Recent reports show that the EU needs to invest €813 billion per year to meet its 2030 climate targets, equivalent to 5.1% of EU GDP. In 2022, real economy investments amounted to €407 billion euros, resulting in a European climate investment deficit of €406 billion euros per year, or 2.6% of EU GDP. In its 2040 climate policy recommendations, the Commission pointed out that in order to achieve 90% of reduction of greenhouse gas emissions by 2040, the EU will need to invest almost €660 billion per year in energy and €870 billion per year in transport between 2031 and 2050 period. Climate inaction is costly: the cost of doing nothing would rise to €347 billion euros annually by 2100, while adopting a 1.5°C transition path would require €94 billion per year – four times less.

Investment is also needed to fight poverty, inequality, and the cost-of-living crisis. In 2020, the Commission estimated that additional investment needs for social infrastructures had increased to 192 billion a year. Recent studies highlight the importance of public investment to meet our social and green investment needs and of increasing annual investment by €120 billion in health, €57 billion in affordable housing and €15 billion in education.

Finally, the EU will need a sound financing strategy to match its industrial policy ambitions. As the political momentum shifts towards competitiveness, Mario Draghi has called for “bold action” to channel both public and private investment.

An EU with a sound investment plan to secure our future

SOLIDAR regrets the adoption of these new rules, which risk jeopardising socially just green and digital transitions. Moving forward, the EU needs to invest massively in the areas critical to its future. By mobilizing massive public resources to advance just green and digital transitions, it can pursue its objectives set in the Paris Agreement, the European Green Deal and the European Pillar of Social Rights. Political action should match the scale of the challenge

To pursue such goals, SOLIDAR advocates for the following measures:

- Establish a central fiscal capacity and an investment plan on the same scale as NextGenerationEU to support social and green investments that benefit people, workers and the environment.

- Develop a harmonised taxonomy to define public investment and better guide member states under this new financial instrument .

- The European Semester process should ensure meaningful participation of civil society organisations, strengthen its social objectives vis a vis the macroeconomic ones including though a more ambitious social convergence framework.

- Promote a green and fair tax reform at national level to ensure the fairness of tax-benefit systems and social protection systems, especially for people affected by the green transition and notably the most vulnerable. This can be done by preserving the progressive character of direct taxation and safeguarding the financing of adequate social protection.

- Develop initiatives similar to the SURE mechanism for the green transition. The SURE mechanism provided financial assistance to countries to mitigate the negative economic and social consequences of the Covid-19 pandemic and that proved useful to protect employment and people.

- Reconsider suspending the 3% and 60% thresholds to foster green and social investments in the light of the magnitude of the public investment needed in these areas.